Stock Updates

Kraft Heinz (KHC)

I originally started buying Kraft Heinz expecting some sort of corporate activity. The stock has been a dog for a decade, and consumer product companies rarely stay still for long. Things were going according to plan (hopes) when they announced splitting up Kraft and Heinz – the latter the only one I was really interested in.

Then the CEO had the brilliant idea last week to keep the company together and run what I call the dying retail playbook – spend a bunch of money on marketing and R&D and hope things change. More often than not, it doesn't work.

People will be flavoring food with ketchup a hundred years from now. I don't know if they'll be eating Kraft Mac n Cheese. As much as I love KegChup and wanted a ketchup royalty into perpetuity, I am not on board for a "focus on marketing and research" and "increasing investments in R&D by approximately 20%..."

Splitting up the company in the future is still on the table. If they do, I may look at it again. I still think it's probably fair value to marginally cheap. But, for now, I'm out.

Entry (price when first mentioned): $25.59

Exit (price at last close): $24.80 + dividends

Return: -2% vs +0.23% SPY

Results for stocks I write about are listed at the below page.

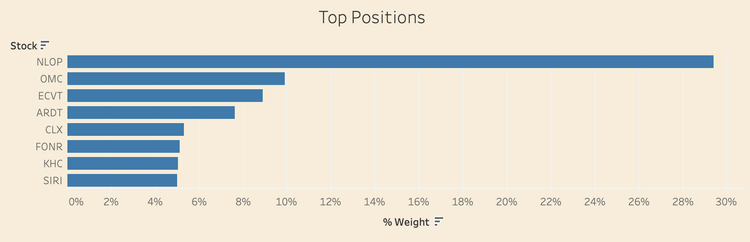

Net Lease Operating Properties (NLOP)

The thesis behind NLOP was always that the likelihood that I'd lose money was almost nil and there was an attractive range of outcomes to the upside. I'll take those bets all day.

As it's gone along, there's been a series of disappointing property sales that have basically limited how much upside is left on it. My personal return was about 10%, but since writing it up in November at $29.71 there has been $9.20 in dividends, and a closing share price on Feb. 13th of $19.80. From the write-up (if that's what you want to call it) date, that works out to a net loss. If I didn't have anything else to buy, I would have held through the remainder of the liquidation, but I sold to buy something else.

Entry: $29.71

Exit: $19.80 + dividends

Return: -1% vs +0.23% SPY

Clorox (CLX)

Clorox is up 18% since I wrote about it at $108 a few months ago. My cost basis was closer to $100. It's closer to my view of fair value at $126 now, so I sold.

Entry: $107.75 (first mention)

Exit: $125.94 (last close) + dividend

Return: 18% return vs +0.23% SPY

Ecovyst (ECVT)

ECVT was one of my largest positions. I already felt like I was paying more than I wanted to, but expected decent results going forward. It's up 36% in about 3 months.

Entry: $8.56

Exit: $11.62

Return: 36% vs 2% SPY

I'll keep watching it in case it gets cheap again.

Omnicom (OMC) / Publicis Groupe (PUB.PA)

By far my largest positions are OMC and PUB.PA. The two now make up 90% of my portfolio. That is not financial advice. (chuckles "I'm in danger.")

These two companies account for about a third of global media agency market share, and trade below 10x FCF. The business is stickier than people give it credit for, and the cash flows more resilient. There's a lot more to these companies than just "creative." AI will put pricing pressure on some parts of their business, but provide margin expansion to others. I think margins will hold well if not expand over time. Either way, at these valuations it's hard to lose money over time.

If I had the opportunity to put 100% of my net worth into acquiring all of OMC and PUB.PA outright at these valuations, I would do it. So, here I am, pretending.

Reflection

I've been investing for over 15 years now. Which isn't as cool as it sounds because I'm only 31. But then again, compared to a lot of other people I see on Twitter, it is. I bring that up as an asterisk to my position sizing.

I've been doing this long enough – and keeping notes / spreadsheets – that I have a decent sample size of what I've done over the last fifteen years. What has gone right (I'm good at valuing things) and what has gone wrong (leverage and selling too soon – fixed the former; latter is every New Year's resolution). What I'm good at and what I'm not. Even though it's all been within the confines of one of the longest and strongest (synthetic) bull markets of all time.

Over that time I have developed (a resistance to say things like "circle of competence") a very specific "strike" zone, and every 12-18 months an idea comes along in that zone that I'm comfortable betting a lot on. My hit rate there is very good (famous last words). The rest of the time I mess around trading in and out of things in smaller size, waiting. The one thing I need to be better about is, ironically, buying and actually holding those big bets.

I could change my mind tomorrow on OMC and/or PUB.PA. I wanted to hold Heinz for 50 years, and now I'm out. I have very little attachment to my ideas. So, I think the odds are good for OMC and PUB.PA, and I'm using this forum as a public journal. But, for all sorts of reasons, please don't copy me – even buying 2% positions because I'm so confident in it. Do your own work. Develop your own circl...err, strike zone. Take notes. Reflect. Figure out what works for you and stick with it.

Member discussion