Robert A. Pritzker's 100-Bagger

This is the story of an investment Robert (Bob) Pritzker made in his mid-twenties that earned him about 100x on his investment in under two decades.

Investment Summary:

- Capital invested: $26,000

- Holding period: ~19 years

- Bob's share of sale: $2,500,000

- Return: ~96x (excluding possible distributions) | ~27% CAGR

Painting used to be a tradesman's craft. It required skill to use a brush to paint a house without leaving brushstrokes. Then, in the early 1940s, the paint roller was invented, turning everyone into an amateur interior decorator and putting husbands at the mercy of their wives' renovating ambitions.

Painters unions tried to keep members from using them, to no avail. The paint roller was here to stay. A do-it-yourself home remodeling revolution was in full swing, and by 1950, A.N. Pritzker was looking for an angle into this market growing at 20% per year. He had an opportunity to invest in a paint roller business in Milwaukee and asked his son, Bob, for help.

Bob was the only Pritzker at the time who decided not to study law. In fact, he wanted to be a physicist. But, realizing he didn't have the natural ability to be "one of the greats" he ultimately opted for a degree in industrial engineering, graduating in 1946 at age 19.

After graduating, Bob devised production control systems for small brass works, studied accounting, wrote trade magazine articles on manufacturing, and taught undergraduate courses on statistical quality control methods that would later transform Japanese manufacturing.

At age 22, he spent a summer bicycling around Europe visiting any factories that would let him in. By 24, he was a general manager of an auto parts manufacturer, but quit over office politics and moved on to various consulting roles. His parents, increasingly concerned about his sporadic employment record, asked his brother Jay to help find Bob a company to run.

Around the same time, A.N. Pritzker was eyeing the investment in a paint roller business in Milwaukee – possibly EZ Paintr, which went on to gain almost 30% market share by 1968. A.N. asked Bob to help vet the deal.

So Dad said, "Why don't you look into it?" One of the ways I looked into it was I asked everybody I knew, including Jay, if they knew anybody from another paint roller company. It turned out a lawyer friend of Jay's had a client who was in the paint roller business. So I called the guy, Stan Graham, and I said, "Could I come over to see you? I'd like to learn a little more about the paint roller business." He was a very nice guy, very outgoing.

I asked Stan about the company Dad was interested in and he told me a lot about the business. Then he asked me if I might want to buy into his company. I was on the shelf, biding time. I looked at his books and found his net worth was $26,000. I matched it and got a half interest.

Circa 1951, Bob and Stan Graham formed a partnership, S-X Graham. The following year, the company rebranded as Essex Graham Company. Bob handled operations, cleaning up what he called a "lousy little business," while Graham handled sales. But, while Graham was a good salesman, he paid little attention to costs which made Bob nervous.

Then, on "a cool spring afternoon in 1953," Jay called Bob with another opportunity. "Bob, I think I've finally found one for you."

The opportunity was The Colson Corporation – the origin of The Marmon Group – and a story for another article.

But, in order for Bob to work with Jay on Colson, Bob reportedly extricated himself from the paint roller business. According to Rodengen's The Marmon Group: The First Fifty Years,

"I had a college friend who was looking for something to do, so I asked him if he would like to buy my half interest," Bob remembered. "He said, 'Sure,' but my partner wouldn't accept him. So about three weeks later, my partner came to me and said, 'I think I'd like to move to California. Why don't we sell the whole company?' I ended up selling my half that I bought for $26,000 for about $2.5 million"

Thus free from his partnership, Bob turned his whole attention to the Colson Corporation.

The implication seems to be that Bob sold his interest in the paint roller business. If true, he made about 100x his money in approximately one year. I have a lot of respect for the Pritzker family's business and investment acumen, but that seems a bit absurd.

Additional evidence supports the idea that Bob didn't sell.

In July 1953, the Chicago Tribune reported that a group headed by Henry L. Freund – Bob's college friend – purchased control of Essex Graham from the founder, Stanley Graham. A separate Marmon Group internal history confirms that Freund "bought Stanley Graham's half-interest and was now Bob's partner."

It could be that Bob tried to sell his half interest in the company to focus on Colson with Jay. Stanley Graham didn't want to work with Henry Freund and/or ultimately wanted to retire. So, Freund bought Graham's half interest, took over management of the company to allow Bob to focus on Colson with Jay, and Bob kept his half ownership in the paint roller.

For the next ~17 years, Essex Graham became a compounder. Henry Freund became President, predicting in 1953 that the industry would sell 8 million units that year at an average retail price of $3 per unit.

Freund seems to have been an important friend early on. When Colson needed space for rocket contracts, Bob shipped Colson's wheelchair division to Essex Graham in Chicago, where Freund managed production. In 1956, Freund moved from President of Essex Graham to Executive VP of Rockwood & Co, and brokered the sale of Rockwood's plant and chocolate division to Tootsie Roll.

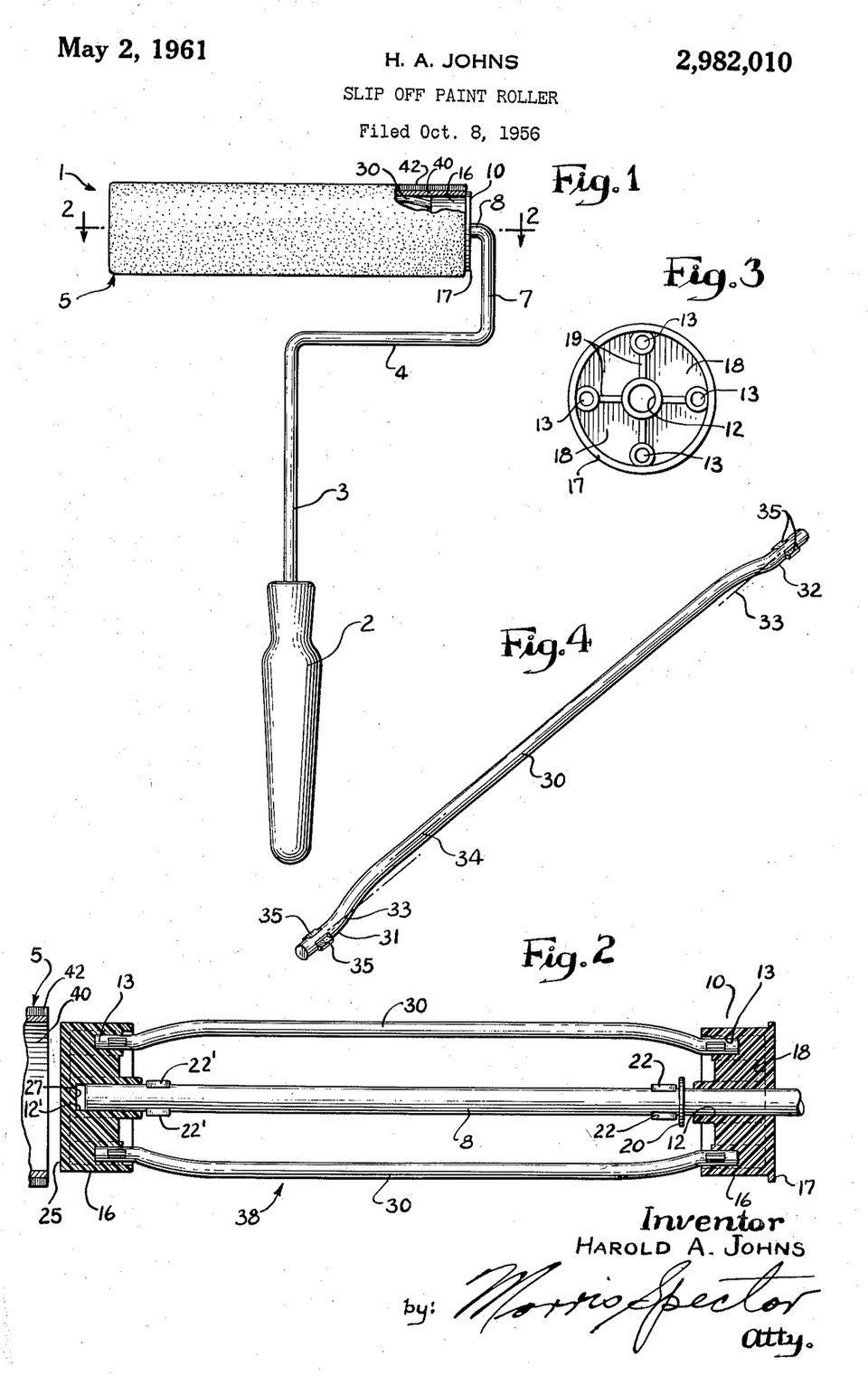

Aside from an industry DIY tailwind, Essex Graham invented the "Slip Off" roller and by 1969, the "lousy little business" had grown to $2.3 million in assets, $2.2 million in sales and had more than 7% of the U.S. paint roller market.

In 1970, Beatrice Foods acquired Essex Graham. While the final sale price wasn't disclosed, Bob's memory of receiving $2.5 million for his half makes more sense against the 1969 asset base and market position disclosed in FTC documents.

In 1975, the FTC ruled that Beatrice's purchase of Essex Graham (combined with its earlier purchase of Tip Top Brush) was anti-competitive and Beatrice was forced to divest Essex Graham.

Summary

Bob Pritzker recapitalized a struggling Chicago paint roller business, turned it into a growth business that ranked fifth in terms of market share and compounded ~27% for two decades (excluding potential distributions or salary). As a side gig.

For most people, a single 100-bagger would be a lifetime accomplishment and life-changing wealth. But for Bob and the Pritzker family, they were just getting started.

Sources

- 1953-02 "Outboard bearing design of paint roller calls for DIE CAST construction" - Precision Metal Molding

- 1953-07-18 "Control" - Chicago Tribune

- 1953-09-12 "Paint" - The New York Times

- 1961-05-02 "Slip Off Paint Roller, Patent 2,982,010" - United States Patent Office

- 1975-04-19 "Man of mystery; Norman Breakey, paint roller inventor" - The Brandon Sun

- 1975 Federal Trade Commission Decisions: In The Matter of Beatrice Foods Co.

- 1998 "The Making of the Marmon Group" by Jack Steinberg

- 2002 "The Marmon Group: The First Fifty Years" by Jeffrey Rodengen

Member discussion