Rapid Round

Something I've done for a long time is keep a journal (random scraps of paper and iPad doodles) + spreadsheet with companies I think I understand, and write down a few lines with upside/downside targets. And then revisit it in 2, 3, 5 years. I find it useful.

I could keep doing this privately, but why not seize the opportunity to look like a fool in public.

I'll keep the running tally here:

FONAR Corp (FONR): Closed

In July, FONAR received a non-binding proposal from the CEO to acquire the outstanding shares in a going-private transaction for $17.25 per share in cash. I figured the deal would get rubber-stamped at a slightly higher price than $17.25. Sure enough, on December 29, FONAR signed a definitive agreement for $19.00 per share cash.

The stock traded up above $18.80 on the news. With the deal not expected to close for another ~6 months, I closed the position at $18.81 average price.

Sometimes it's the stocks no one cares about that work best. People had plenty of time to build a position at great prices – it traded as low as $14 at the end of November.

I published the FONAR article mid-August at $15.17. That's 24% absolute return compared to 7% for the S&P during the same period.

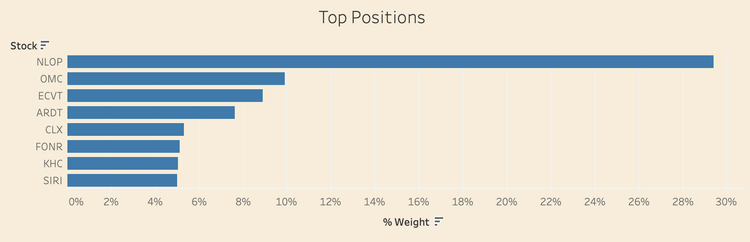

Omnicom Group (OMC)

My largest position. I expect it to be my largest position for a while. I wrote more about it here:

The combined OMC + IPG company has ~16% global media agency market share.

Pro forma OMC + IPG trades at a single-digit FCF multiple. Minimal capex, negative working capital, buying back stock. $750M targeted cost synergies. I view AI as a tailwind given the human capital intensity of the business.

Risks: Merger execution. Publicis.

Share Price: $68

Price Target: $102 to $160+

Upside (downside): +50% to +140%

Publicis Groupe (PUB.PA)

Best operator in advertising in my opinion. Now my third largest position. Publicis has ~12% global media agency market share.

€2 billion free cash flow before working capital adjustments, €2.6 after. €10 billion equity. €550 net cash. €20B market cap.

Publicis has a first-mover data/integration advantage and a unified platform.

Risk: Epsilon/Sapient/data privacy regulation

Share Price: €77

Price Target: €121.50

Upside (downside): +60%

Ecovyst (ECVT)

You can read about the valuation etc in the article I wrote here:

They're the North American market leader in chemical recycling for refineries, with a business model that supports 70%+ cash conversion, stable/durable margins. They closed the sale of Advanced Materials & Catalysts. Should generate north of $65M FCF.

My cost basis is $8.85. The increase in the stock price in a short amount of time has shifted the risk/reward and I've trimmed some of the position.

Risk: U.S. refining capacity declines. Capital allocation – strong balance sheet used to do a bad acquisition.

Share Price: $11

Price Target: $6.50 to $14

Upside (downside): (-40%) to +27% from current price

Kraft Heinz (KHC)

$2.50/share FCF. $25 stock. $15/share debt. 6.5% dividend yield.

Berkshire may not be happy about the planned breakup, but I am. Pass me the ketchup.

Share Price: $25

Price Target: $24 to $35

Upside (downside): fair value to +40%

DaVita Inc (DVA)

Your kidneys clean your blood. If your kidneys stop working, your blood stops getting cleaned and you die. DaVita provides kidney dialysis (the process of cleaning your blood). That's a sticky business.

They conservatively generate $1B free cash flow. Mid-point 2026 FCF guidance is $16.40 per share. Buying back huge amounts of stock.

Risk: dialysis becomes a political piñata / reimbursement rates. Can't predict that so would never make it a large position. But, there's a price and size for everything.

Share Price: $142

Price Target: $225

Upside (downside): +60%

SiriusXM (SIRI)

SIRI reports earnings in 7 hours which should be fun. $1-1.3B normalized FCF as capex cycle runs off. $7 billion market cap. Expect next several years to be focused on deleveraging.

Wide range of values depending on sub losses, ARPU, and capex declines.

Share Price: $21

Price Target: $15 to $65

Upside (downside): (-30%) to +210%

Ardent Health (ARDT)

Karst Research has a good overview of Ardent Health.

I have ~$190M normalized FCF and think cost overruns will subside sooner rather than later, and stock re-rates to $17-20.

Not something I want to own forever, but it's cheap and I think the reason the stock declined so much is over temporary problems.

Risks: bad acquisitions, reimbursements, inflation.

Share Price: $8.55

Price Target: $17-20

Upside (downside): +100% to +130%

Conagra Brands (CAG)

Name brand frozen/refrigerated foods. If volumes stabilize I think there's modest upside.

Risks: private label, inflation, no pricing power

Share Price: $19.80

Price Target: $25 to $26

Upside (downside): +25% to +30%

Net Lease Office Properties (NLOP)

Still in liquidation. Paid $3.10 in September, $4.10 in December and $5.10 in January. They also announced another $6.75 payable in February. Sale prices haven't been exciting. Don't think I lose money but most of the upside has been capped. Reinvesting elsewhere.

Cable One (CABO)

Lone Elm Capital put together a great write up to understand the situation.

$150M normalized FCF on $550M market cap. Leveraged equity stub in a very hated industry. I don't think CABO is going bankrupt. Could get acquired or stabilize and rerate. Will take some time to clean up the balance sheet.

Risks: fiber overbuild; FWA; debt

Share Price: $101

Price Target: $120 to $380

Upside (downside): +20% to +275%

Summary

Will do more of these from time to time in batches like this. Remember, not investment advice. Not research. Not selling anything to anyone.

Just want a central place to keep track of what I look at/own.

Should be interesting to look back on 30 years from now.

Member discussion